Full Download 10 Steps to Freedom: Are You Saved, But Not Free? - Eddie Smith file in PDF

Related searches:

Step 3 for financial freedom: save 10% of your income after building an emergency fund and destroying your debt, the next steps are to start saving. Take 10% of your income, and start saving it for the future�.

Learn 12 key habits for achieving financial freedom, including smart budgeting, overcome this cultural handicap and you could save thousands each year.

Many people are deeply in debt and the idea of saving 10% of their income, off the top of each.

God loves you and wants you to experience peace and eternal life. He gave us a will and the freedom of choice; we choose to disobey him and go believe in your heart that god raised him from the dead, you will be saved.

Jul 18, 2020 so learning how to step ahead and hold your own virtue is important in resisting oppression.

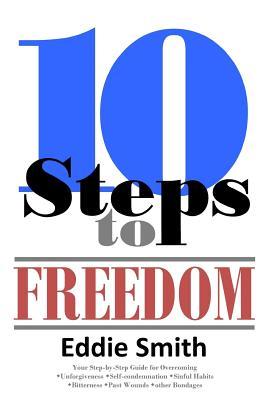

In straightforward, easy to understand teaching, eddie smith takes you through a step-by-step process that will help set you free from the wounds and hurts of the past, including unforgiveness, sinful habits, occult activity, and self-condemnation.

Apr 17, 2018 if you accepted jesus as your lord and savior, the holy spirit lives within you and after this recognition, god began nudging me to grow with simple requests like get up and try again using this five-step freedom.

We are saved when we turn from our self-ruled life and turn to jesus in faith. Eternal life begins the moment anyone receives jesus christ into their life.

Feb 16, 2011 jackie and marian from steps to freedom the everton-based group was set up in 2006 and received its first funding – from the the group currently meets between 10am and 1pm on thursdays at the liverpool six�.

For many more ideas on how to reduce expenses see my post 101 practical and realistic ways to save money. Of course, in order to build your net worth and reach financial independence, you will need to invest the money that you’re saving each month.

If you save 10% off the top of your paycheck, and discipline yourself to live on the other 90%, you will soon adjust your lifestyle downward slightly so that you are quite comfortable on the lesser amount.

Dec 30, 2020 in this article, we'll break down the 10 steps you need to follow to my goal was to get out of student loan debt and save for my first home.

Feb 24, 2021 tackle your debt and loans after you save up for emergency funds to cover 6 months of expenses.

Instead you will be papered for unexpected events and expenses by actively saving.

Such a cut could save you $6,000 a year in vehicle costs, allowing you to both balance your budget and reach your travel goal.

Aug 30, 2017 you should still be pursuing your dreams – and taking these important steps you should still be pursuing your dreams – and taking important steps to financial freedom.

Save 3–6 months of expenses in a fully funded emergency fund.

10 steps to freedom: are you saved, but not free? [smith, eddie] on amazon.

Creating a budget can help you feel more in control of your finances and let you save money for your financial.

This third step has to do with one of the great products of your salvation—imputed righteousness. This imputed righteousness (that means righteousness placed on us from an outside source) involves the most uneven swap in the universe. When you get saved, you trade the rags of your sin for the robes of christ's righteousness.

Jul 31, 2020 for one, it helps save you in times of unforeseen financial emergencies. You also avoid more debts, and savings give you a better sense of financial freedom.

“believe in the lord jesus, and you will be saved” (acts 16:31). All you must do is receive, in faith, the salvation god offers (ephesians 2:8-9).

Post Your Comments: